The Future of Cryptocurrencies and Artificial Intelligence: Technological Symbiosis?

The Future of Cryptocurrency and Artificial Intelligence: A Technological Symbiosis?

As the world increasingly relies on technology, one of the fastest-growing areas is artificial intelligence (AI). From self-driving cars to personalized medicine, AI has the potential to revolutionize many aspects of our lives. But its impact extends far beyond healthcare and finance, as it is also playing a significant role in shaping the future of cryptocurrencies. In this article, we will delve into the intersection of cryptocurrency and artificial intelligence, exploring how these two technological forces can complement each other and potentially create a new paradigm for digital assets.

The Rise of Cryptocurrency

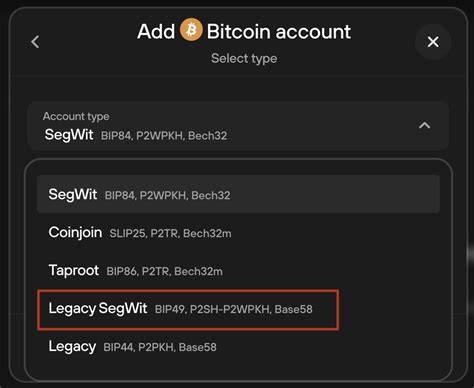

Cryptocurrencies have emerged as a distinct category of digital assets, using blockchain technology to secure and verify transactions without intermediaries. With over 5,000 cryptocurrencies currently trading on exchanges, the market is highly competitive and evolving rapidly. The total value locked (TVL) of cryptocurrencies has grown exponentially in recent years, with some markets seeing price increases exceeding 10x their initial valuation.

The Power of AI

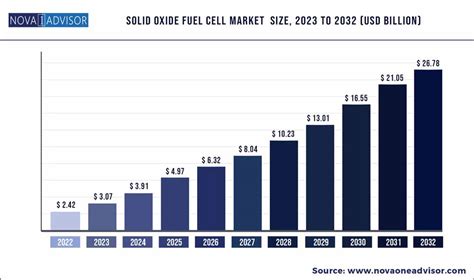

Artificial intelligence has long been a topic of interest to investors, entrepreneurs, and policymakers. As the global economy continues to grow and mature, so too does the potential for AI to transform industries. From supply chain management to predictive maintenance, AI can streamline processes, optimize performance, and reduce costs.

Symbiotic Relationship Between Cryptocurrency and AI

One of the most exciting aspects of this technological symbiosis is the potential for cryptocurrency and AI to work together in innovative ways. Here are a few examples:

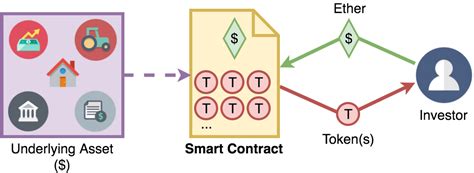

- Smart Contracts: Smart contracts driven by AI can automate complex transactions on blockchain networks, reducing errors and increasing efficiency.

- Predictive Modeling: Machine learning algorithms can analyze vast amounts of data from various sources, enabling predictive modeling that helps investors make informed investment decisions.

- Decentralized Finance (DeFi)

: AI-driven DeFi platforms can optimize lending rates, reduce borrowing costs, and create new revenue streams for lenders.

Case Study: Bitcoin-Based Stablecoin

In 2018, researchers at the University of California, Berkeley proposed a stablecoin that would peg the value of Bitcoin (BTC) to the US dollar. Dubbed « Bitcoin USD, » the stablecoin was intended to eliminate price volatility and provide investors with a reliable store of value.

Advantages and Challenges

While the symbiosis between cryptocurrency and AI holds great potential, it also presents a number of challenges:

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving, making it difficult for developers and investors to predict what the future holds.

- Security Risks: As with any decentralized network, there are security risks associated with blockchain technology and cryptocurrency trading.

- Scalability Issues: Current scalability solutions often struggle to handle high transaction volumes, limiting the adoption of cryptocurrencies in some markets.

Conclusion

The intersection of cryptocurrency and AI is a rapidly evolving area with enormous potential for innovation. As the world continues to rely on technology to solve complex problems, it is likely that this symbiosis will play a significant role in shaping the future of digital assets. Although challenges remain, the benefits of the technological symbiosis between cryptocurrency and artificial intelligence are undeniable.