Whale, Wallet, Mnemonic

The Rise of Crypto: How Blockchain Technology is Changing the World

As the world becomes increasingly digital, cryptocurrency has emerged as a new frontier in financial technology. Bitcoin and other cryptocurrencies have gained popularity over the years, with millions of users around the globe. But what makes these digital currencies tick? In this article, we’ll delve into the world of crypto, exploring its underlying mechanics, popular platforms, and the importance of wallet management.

What is Crypto?

Cryptocurrency is a digital or virtual currency that uses cryptography for secure financial transactions. It’s decentralized, meaning it’s not controlled by any government or institution, and operates on a network of computers working together to validate transactions. The most well-known cryptocurrency is Bitcoin (BTC), which was first introduced in 2009.

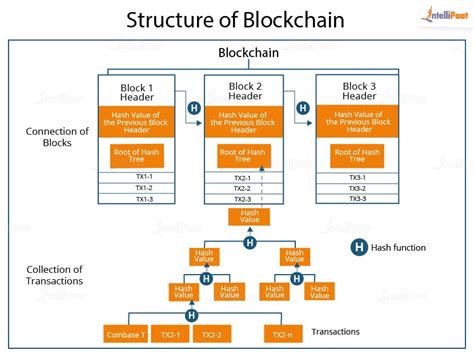

The Blockchain: A New Way of Thinking

Blockchain technology is the underlying infrastructure of cryptocurrency, allowing for secure, transparent, and decentralized transaction processing. It’s like a digital ledger that records all transactions on a network, ensuring that every node has an accurate copy of the data. This consensus mechanism allows for peer-to-peer transactions without the need for intermediaries.

How does Crypto Work?

Here’s a simplified overview:

- Mining: New cryptocurrency units are created through a process called mining, which involves solving complex mathematical problems to validate transactions and secure the network.

- Wallets

: Users store their cryptocurrencies in digital wallets, such as software programs (e.g., MetaMask) or hardware devices (e.g., Ledger Nano X).

- Transactions: When a user wants to send cryptocurrency to another party, they initiate a transaction by creating a signed message with their private key.

- Verification: The blockchain network verifies the transaction and ensures that the sender has sufficient funds.

- Blockchain update: Once verified, the transaction is added to the blockchain, which is updated on every node on the network.

Popular Crypto Platforms

Some of the most popular platforms for buying, selling, and storing cryptocurrencies include:

- Bitcoin (BTC)

- Ethereum (ETH): Known for its smart contract platform, Ethereum enables the creation of decentralized applications.

- Litecoin (LTC): A faster and more lightweight alternative to Bitcoin, Litecoin is ideal for everyday transactions.

- Ripple (XRP): Focuses on cross-border payments and financial inclusion.

The Importance of Wallet Management

Wallets are essential for storing cryptocurrencies securely. To avoid losing your investment or wallet data, it’s crucial to use a reputable wallet provider that offers features such as:

- Two-factor authentication

: Additional verification steps beyond passwords.

- Decentralized storage: Using multiple layers of security, such as encryption and off-chain storage.

- Regular backups: Securely storing your wallet private keys in an external device.

Conclusion

The world of crypto is rapidly evolving, with new technologies and innovations emerging all the time. By understanding how blockchain technology works and the importance of wallets for secure storage, you can make informed decisions about investing in cryptocurrencies or using them as a convenient means of exchange. Whether you’re a seasoned investor or just starting to explore this new frontier, the world of crypto is here to stay.

Mnemonic: Your Digital Wallet

To further enhance your cryptocurrency experience, consider using mnemonic tools like:

- Ledger Live: A mobile app that helps you generate and store complex wallets.

- MetaMask: A popular browser extension for Ethereum users, allowing them to interact with the blockchain directly from their web browsers.