“Biting the Bullet of Blockchain: The Complex Interplay Between Cryptocurrencies, Supply Chains, and Fiat Currencies”

In recent years, cryptocurrency has gained traction in various industries, and many companies and organizations are exploring its potential to revolutionize traditional supply chains. However, integrating cryptocurrencies into these complex systems requires careful consideration of several factors, including security, scalability, and regulatory compliance.

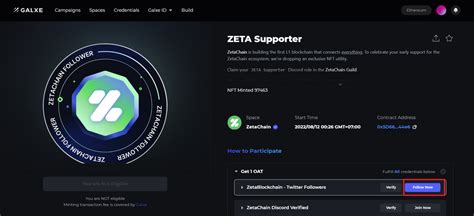

One area where cryptocurrencies are gaining increasing attention is the realm of testnets. A testnet is a simulated blockchain environment where developers can test and iterate on new features and ideas without risking real-world assets. By running a testnet, companies can validate their own cryptocurrencies or tokens before deploying them in live markets.

For example, one prominent cryptocurrency, Ethereum, has used its testnet to develop various smart contracts and decentralized applications (dApps). These innovations have far-reaching implications for the entire industry, including increased security, improved scalability, and expanded functionality. In this sense, the testnet is not only a platform for testing new ideas but also a key driver of innovation.

Another important aspect of integrating cryptocurrencies into supply chains is ensuring their security and tamper-proofness. Traditional supply chain management systems often rely on manual processes and paper-based records, making them vulnerable to cyberattacks and data breaches. In contrast, cryptocurrencies provide a decentralized and transparent ledger that can help prevent these types of problems.

For example, companies like Walmart and Maersk have explored using blockchain technology in their logistics operations. By using cryptocurrencies like Bitcoin or Ethereum, these organizations can create secure and tamper-proof records of shipments and transactions. This can lead to significant cost savings, improved efficiency, and increased customer trust.

However, there are also concerns about the introduction of fiat currencies into cryptocurrency ecosystems. Fiat currencies like the US dollar or the euro are not backed by physical assets and are often subject to government manipulation and censorship. Some critics argue that cryptocurrencies could be vulnerable to economic instability and that their use could exacerbate existing inequalities.

In response to these concerns, some companies have explored alternative solutions such as decentralized stablecoins. These stablecoins use a combination of traditional currency and cryptocurrency components to maintain price stability in fiat markets. By providing a secure and transparent alternative to traditional currencies, decentralized stablecoins can help mitigate the risks associated with fiat currencies.

Despite these challenges, integrating cryptocurrencies into supply chains is a promising area of development. As the technology matures and more companies adopt it, we can expect to see increased adoption across industries, from finance to logistics. The complex interplay between cryptocurrencies, supply chains and fiat currencies requires careful consideration and collaboration between stakeholders, but the potential benefits are significant.

In summary, integrating cryptocurrencies into supply chains is a complex issue that requires careful consideration of security, scalability, and regulatory compliance. By understanding the benefits and challenges associated with these technologies, companies can make informed decisions about how to integrate them into their operations. As the industry continues to evolve, it will be exciting to see how cryptocurrencies adapt to changing market conditions and become a major player in the global economy.

Laisser un commentaire